When you’re choosing a health plan, it’s easy to focus on the monthly premium and forget about what happens when you need your meds. But here’s the truth: prescription insurance isn’t a bonus - it’s a lifeline. Sixty-seven percent of U.S. adults take at least one prescription drug. If you’re on insulin, blood pressure pills, antidepressants, or even a monthly antibiotic, your plan’s drug coverage can save you thousands - or cost you more than you ever expected.

Is My Medication Even Covered?

The biggest mistake people make? Assuming their meds are covered. Every plan has a formulary - a list of drugs it agrees to pay for. But not all drugs are created equal. Formularies are split into tiers, and each tier has a different price tag.- Tier 1 (Generic): Usually under $10 per prescription. These are the go-to options for most insurers.

- Tier 2 (Preferred Brand): Around $40. These are brand-name drugs the plan encourages because they’re cost-effective.

- Tier 3 (Non-Preferred Brand): Can hit $100 or more. Your doctor may need to justify why you can’t use a cheaper alternative.

- Tier 4 (Specialty): These are high-cost drugs - think cancer treatments, MS meds, or rare disease therapies. You’ll pay 25-33% of the total cost. A single prescription could cost over $1,000.

What’s My Deductible? And Does It Apply to Drugs?

Some plans have a separate deductible for prescriptions. Others combine it with your medical deductible. That’s a huge difference. For example, a Bronze Marketplace plan might have a $6,000 deductible. If your plan applies that to drugs, you’ll pay the full price of every prescription until you hit that $6,000 mark. That’s not practical if you’re on $800/month meds. On the flip side, Gold or Platinum plans often have $150 or even $0 drug deductibles. If you take three or more regular prescriptions, these plans can save you over $1,800 a year - even with higher premiums.Do I Need Prior Authorization or Step Therapy?

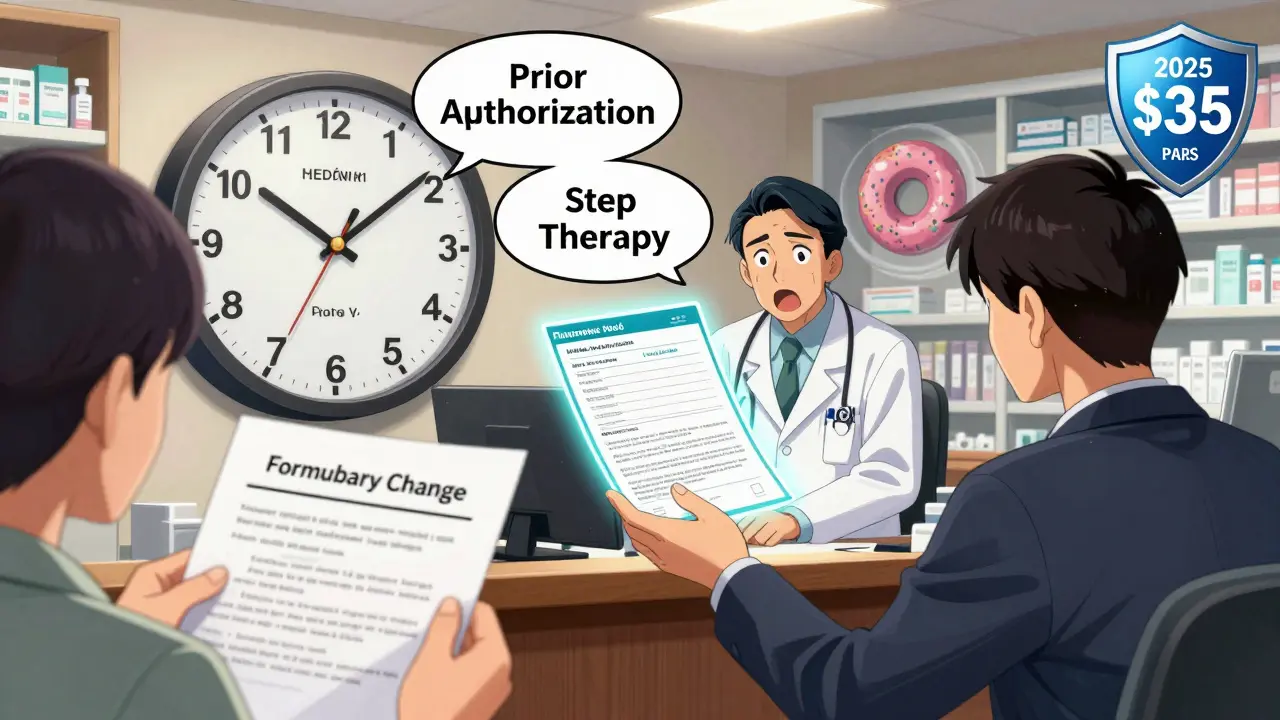

Just because a drug is on the formulary doesn’t mean you can walk in and get it. Many plans require prior authorization. That means your doctor has to send paperwork proving you’ve tried cheaper options first - or that the drug is medically necessary. If they don’t, the pharmacy won’t fill it. Then there’s step therapy. This forces you to try a Tier 1 or Tier 2 drug before the plan will cover your usual one. I’ve seen people on stable medication for years suddenly told, “Try this cheaper one first.” It’s not just inconvenient - it can be dangerous. Ask: “Is prior authorization or step therapy required for any of my medications?” If the answer is yes, find out how long it takes to get approved. Some plans take 72 hours. Others take weeks.

Which Pharmacies Can I Use?

Your plan might cover your drug - but only if you fill it at a specific pharmacy. Nearly 80% of Marketplace plans restrict you to a network of pharmacies. Walk into a non-network pharmacy, and you could pay 37% more. Check if your usual pharmacy is in-network. If not, ask if you can get a mail-order option. Many plans offer 90-day supplies through mail-order with lower copays. For someone on a monthly med, that’s a $200 annual savings. Also, ask about emergency fills. What if you’re traveling and need a refill? Some plans let you get a one-time fill at an out-of-network pharmacy - but only if you call first.What Happens in the Coverage Gap? (The “Donut Hole”)

If you’re on Medicare Part D, this matters a lot. In 2024, once you and your plan have spent $5,030 on drugs, you enter the coverage gap. You pay 25% of the cost until you hit $8,000 in total spending. Then catastrophic coverage kicks in. But here’s the twist: starting in 2025, the donut hole is disappearing. You’ll pay no more than $2,000 out-of-pocket for all your drugs in a year. And insulin will cost no more than $35 per month. Even if you’re not on Medicare now, knowing these changes helps you plan ahead. If you’re on a long-term med, you’re likely to be on Medicare in the next 5-10 years. Make sure your current plan’s structure won’t leave you scrambling later.How Much Will I Pay in a Year?

Don’t just look at monthly premiums. Calculate your total annual cost:- Monthly premium

- Drug deductible (if any)

- Copays or coinsurance per prescription

- Out-of-pocket maximum for drugs

When Should I Review This?

Open enrollment isn’t just for new people. If you’re on Medicare, the Annual Election Period runs October 15 to December 7. If you get insurance through your job or the Marketplace, it’s November 1 to January 15. Use the tools. HealthCare.gov lets you enter up to 15 drugs and three pharmacies to compare plans side by side. Medicare’s Plan Finder does the same - just make sure you enter your drugs by NDC code, not just the brand name. People who spend 20 minutes checking their meds before enrolling save $1,147 a year on average. That’s not a myth - it’s data.What If My Drug Gets Removed?

Plans can change their formularies mid-year. If your drug gets moved to a higher tier or taken off entirely, you should get a 60-day notice. But don’t wait. Ask: “What’s your process for notifying members if a drug is removed or changed?” Some plans offer temporary coverage while you and your doctor appeal. Others don’t. Find out now.What’s the Best Plan for Me?

If you take one or two generics - maybe a statin and a daily pill - a Bronze or Silver plan might be fine. But if you’re on multiple brand-name drugs, especially specialty meds? Go Gold or Platinum. The higher premium pays for itself. A CMS study found that someone filling 12 maintenance prescriptions a year saves $1,842 with a Gold plan versus a Bronze one. That’s $153 a month - more than the premium difference. Don’t pick a plan based on price alone. Pick it based on your meds.What if my medication isn’t on the formulary?

If your drug isn’t covered, you can ask for an exception. Your doctor must submit a letter explaining why you need it - and why alternatives won’t work. Many plans approve these requests, especially for chronic conditions. If denied, you can appeal. Keep records of all communication.

Can I switch plans if my drug coverage changes during the year?

Generally, no - unless you qualify for a Special Enrollment Period. Common triggers include losing other coverage, moving out of your plan’s service area, or if your drug is removed from the formulary without a comparable replacement. If you’re affected, contact your insurer immediately to see if you qualify.

Does Medicare Part D cover all my drugs?

No. Medicare Part D doesn’t cover drugs like weight-loss pills, fertility treatments, or over-the-counter medications (unless prescribed for a specific condition). Each plan has its own formulary. Always check your specific plan, not just “Medicare” as a whole.

Are generic drugs always cheaper than brand names?

Usually, yes - but not always. Some generics cost more because of supply issues or limited competition. Always compare copays. Sometimes, a brand-name drug in Tier 2 has a lower copay than a generic in Tier 3. Don’t assume.

What happens if I miss a payment on my Medicare Part D plan?

You’ll lose coverage. If you’re late on payments, your plan can drop you. You’ll have to wait until the next enrollment period to re-enroll - and you might owe a late penalty for life. Set up auto-pay. It’s the easiest way to avoid this.

15 Comments

Eric KnobelspiesseFebruary 8, 2026 AT 04:03

so i read this whole thing and honestly? the donut hole thing is kinda a red herring. everyone’s focused on it like it’s the end of the world but guess what? if you’re not on medicare, it doesn’t matter. and even if you are, the new $2k cap in 2025 is gonna save way more people than anyone’s talking about. stop overcomplicating it. just check your tier and move on.Patrick JarillonFebruary 9, 2026 AT 02:05

this is all just corporate propaganda wrapped in nice bullet points. they want you to think formularies are fair. they’re not. the real game is making you believe you have CHOICE. the drug companies own the formularies. the insurers are just middlemen. and don’t even get me started on mail-order pharmacies - that’s how they track your usage and raise your rates. this whole system is designed to keep you dependent. wake up.Ritu SinghFebruary 9, 2026 AT 12:03

As someone who manages chronic care for elderly parents in India and the U.S., I can confirm that the tiered system is not unique to America - but the lack of transparency is. In India, we have subsidies, but we also have clear, published formularies. Here, you need a lawyer and a spreadsheet. I urge all readers: document everything. Keep copies of every denial, every prior auth request, every pharmacy receipt. Your future self will thank you.Mark HarrisFebruary 10, 2026 AT 14:48

i just got off the phone with my insurer and they said my insulin is covered but only if i use the mail-order service… which requires a 90-day supply. so now i have to store 3 months of insulin in my fridge? and if i travel? no emergency fills unless i call 3 days in advance. this isn’t healthcare. it’s a puzzle with no solution.Savannah EdwardsFebruary 10, 2026 AT 18:18

I’ve been on a specialty med for five years and I can tell you - the real nightmare isn’t the cost, it’s the emotional toll of constantly proving you’re worthy of care. The prior auth process feels like begging. I’ve had to send letters from my doctor, my therapist, my pharmacist, my primary care, and then wait weeks while my symptoms worsen. It’s not just inconvenient. It’s dehumanizing. And no one talks about that part.Mayank DobhalFebruary 10, 2026 AT 20:05

tier 4 drugs are a scam. if you need them, you’re already broke. why make you pay 30%? just give us the drug. this isn’t capitalism. it’s cruelty with a spreadsheet.Marcus JacksonFebruary 12, 2026 AT 10:23

the article’s right about checking tiers but misses one thing: pharmacies negotiate rebates behind the scenes. your $1200 drug might be $300 at one pharmacy and $900 at another - even with the same insurance. call around. it’s not hard. and don’t trust the online tools - they’re outdated 80% of the time.Natasha BhalaFebruary 13, 2026 AT 00:37

i just want to say thank you for writing this. i was about to pick a cheap plan until i realized my anxiety med was tier 3. i almost cried. now i know to ask about deductibles and mail order. you saved me money and stress. really. thank you.Gouris PatnaikFebruary 14, 2026 AT 20:10

this is why america fails. you let corporations dictate life-saving care. in India, we don’t have tiered formularies. we have rationing - but at least it’s honest. here, you’re lied to with spreadsheets. you’re not sick. you’re a revenue stream.Ashley HutchinsFebruary 16, 2026 AT 18:18

if you’re on insulin and paying more than 35 a month you’re doing it wrong. this article is too soft. the real problem is big pharma. they’re the ones setting prices. not insurers. not doctors. stop blaming the system and go after the real villainsSarah BFebruary 18, 2026 AT 06:41

if you cant afford your meds dont take themTola AdedipeFebruary 18, 2026 AT 14:28

this is why universal healthcare isn’t just moral - it’s economic. in Canada, we have formularies too, but no one pays $1000 for a single pill. if you’re still defending this tiered mess, you’re either rich or brainwashed. pick one.Heather BurrowsFebruary 20, 2026 AT 00:51

i mean… i guess this is helpful? but honestly i just take what my doctor gives me and pay what they say. i don’t have time to research tiers and formularies and prior auth. i have two kids and a job. if this is the best we can do… we’re doomed.Amit JainFebruary 22, 2026 AT 00:11

you think the donut hole is bad? wait till you find out your plan drops your med mid-year and gives you 14 days to appeal. i had to switch from my only stable antidepressant because they moved it to tier 5. i had a panic attack. my doctor said ‘try citalopram’ - like that’s the same thing. this isn’t healthcare. it’s russian roulette with pills.Jesse LordFebruary 23, 2026 AT 00:39

i just want to say - if you’re reading this and you’re scared, you’re not alone. i’ve been there. i cried in a pharmacy parking lot because i couldn’t afford my thyroid med. but i called my insurer. i asked for the exception form. i sent the letter. they approved it. it took 3 weeks. but i got it. you can too. don’t give up. you deserve to be healthy.