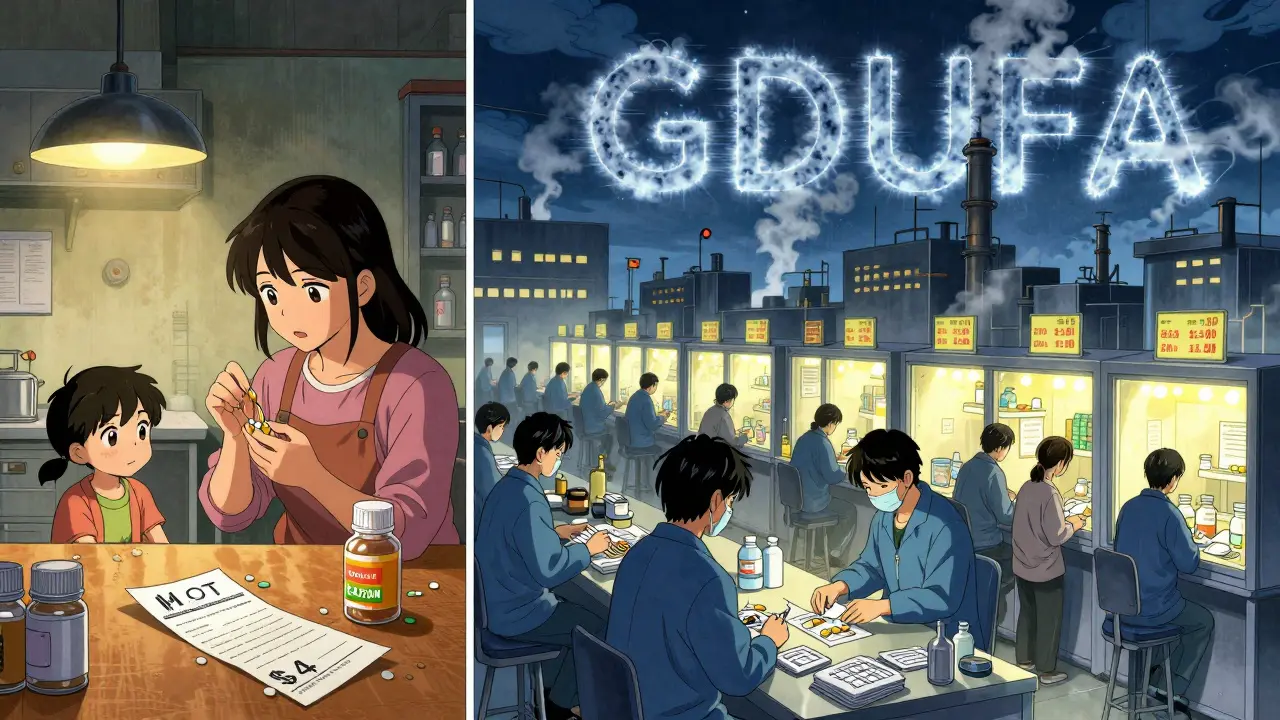

Every year, Americans fill over 4 billion prescriptions for generic drugs. These pills cost a fraction of brand-name versions, saving the healthcare system billions. But behind every low-price generic on the shelf is a complex, high-stakes process that only works because of something most people never hear about: generic drug user fees.

What Are Generic Drug User Fees?

In 2012, Congress created the Generic Drug User Fee Amendments (GDUFA) to fix a broken system. Before GDUFA, the FDA took an average of 30 to 36 months to review a generic drug application. Many applications sat untouched for years. Patients waited longer for affordable options. Manufacturers didn’t know when - or if - their drugs would get approved. GDUFA changed that. It lets the FDA collect fees directly from generic drug companies to pay for the review process. These aren’t taxes. They’re user fees - paid only by companies that want their drugs reviewed. In return, the FDA commits to clear timelines and better communication. Today, about 75% of the budget for the FDA’s Office of Generic Drugs comes from these fees.How the Fees Work: Four Types, One Goal

GDUFA isn’t one fee. It’s four different fees, each tied to a specific part of the approval process:- Application fees: Paid when a company submits an Abbreviated New Drug Application (ANDA). In 2023, this cost $124,680 per application.

- Program fees: An annual charge for every company with an approved generic drug. That’s $385,400 per year, no matter how many drugs they have.

- Facility fees: Charged to any manufacturing site - whether making active ingredients or finished pills - that’s listed in an approved application. The 2023 fee was $25,850 per facility.

- Drug Master File (DMF) fees: Paid when a company submits technical data about ingredients (like active pharmaceutical ingredients) that others use in their drugs. The fee is $25,850 per DMF.

Here’s the catch: you only pay a facility fee if the site is referenced in an approved drug. If your facility is only mentioned in a pending application, you don’t pay yet. That helps smaller companies manage cash flow while waiting for approval.

Why This System Exists: Speed, Not Favoritism

Some people worry that paying fees means companies can “buy” faster approval. That’s not how it works. The FDA makes it clear: paying fees doesn’t guarantee approval. It just ensures your application gets reviewed on time. Before GDUFA, the FDA had no steady funding for generic reviews. They relied on Congress, which didn’t always give them enough. That led to delays, backlogs, and uncertainty. Now, with user fees, the FDA can hire more reviewers, upgrade systems, and set measurable goals. GDUFA III (the current version, running through 2027) requires the FDA to:- Review and act on 60% of original ANDA submissions within 15 months

- Communicate 90% of first-cycle review deficiencies within 10 months

- Inspect finished drug facilities every 2 years and API facilities every 3 years

These aren’t empty promises. In 2021, the FDA met 97% of its first-cycle review deadlines. That’s a huge leap from the pre-GDUFA era.

Cost Comparison: Generic vs. Brand-Name Drug Fees

It’s easy to assume generic drug fees are just smaller versions of brand-name fees. But the gap is staggering.- Generic drug application fee (2023): $124,680

- Brand-name drug application fee (2023): $3,405,070

That’s less than 4% of what brand-name companies pay. Why? Because the FDA reviews over 1,100 generic applications each year - compared to fewer than 70 new brand-name drugs. The system is built for volume, not high-value single applications.

But here’s the irony: even though generic fees are lower, they’re still a heavy burden for small manufacturers. One facility fee can eat up 15% of a small company’s entire annual regulatory budget. That’s why some argue GDUFA favors big players like Teva, Mylan, and Sandoz - who control 60% of the market.

Who Benefits? Patients, Payers, and the System

The real winners are patients. Generic drugs make up 90% of all prescriptions in the U.S. but cost only 23% of total drug spending. That’s over $125 billion saved every year. GDUFA has helped speed up access to these savings. Since its launch, generic drug approvals have increased by 22% annually. The Federal Trade Commission estimates GDUFA has helped get generic drugs to market 15% faster after patents expire - saving consumers an estimated $1.7 trillion over the past decade.It’s not perfect. There are still around 1,500 older applications waiting from before GDUFA. And the program doesn’t cover over-the-counter (OTC) drugs - a $117 billion market with no clear review path. But for prescription generics, it’s the best system we’ve had.

Challenges and Criticisms

Despite its success, GDUFA faces real problems. Small manufacturers say the facility fee is unfair. If you run one plant, you pay the same as a company with 10. The Generic Pharmaceutical Association points out that 75% of small firms operate just one facility. For them, the fee isn’t a cost of doing business - it’s a threat to survival. The FDA also admits it’s falling short on its own goals. In 2021, only 52% of applications were approved within 15 months - below the 60% target. Pandemic delays and more complex applications played a role, but it shows even well-funded systems can stumble. Another issue? Fee complexity. Companies must track affiliations - if one company owns more than 50% of another, they’re considered linked. That affects who pays what. Many new regulatory staff take 3 to 6 months to fully understand the rules. And only 18 small businesses applied for the 75% fee reduction in 2022 - even though it’s available. That suggests many don’t know it exists.

What’s Next? GDUFA IV and Beyond

The next round of GDUFA (GDUFA IV) is being negotiated right now. The FDA is pushing to expand the program to cover OTC monograph drugs - which currently operate in a regulatory gray zone. That could bring in $150-200 million more in fees annually. There’s also talk of using real-world data - like patient outcomes from electronic health records - to monitor generic drug safety after approval. Industry groups are cautious. They worry it could add new costs without clear benefits. The FDA’s goal? Cut the pre-GDUFA backlog by 50% by 2025 and eliminate all old applications by September 2024. That’s ambitious - but doable, if funding stays steady.What This Means for You

If you take generic medication - and most people do - GDUFA is working for you. It’s why your $4 prescription is available on time. It’s why new generics enter the market faster after brand-name patents expire. If you work in pharma - especially at a small company - GDUFA is a balancing act. The fees are high, the rules are complex, but the system is predictable. That’s worth something. And if you’re wondering why the FDA doesn’t just use taxpayer money? The answer is simple: without user fees, the review process would still be slow, underfunded, and unreliable. GDUFA isn’t perfect. But it’s the only system that’s made real progress.Generic drugs save lives. GDUFA makes sure they get to the pharmacy.

Are generic drug user fees the same as taxes?

No. User fees are paid only by companies that submit applications for FDA review. They’re not taxes collected from the public. The fees fund the FDA’s review process for generic drugs, and companies pay them to get their products approved faster. The FDA does not use these fees to cover general operations or unrelated programs.

Do small generic drug manufacturers get fee discounts?

Yes. Small businesses that meet specific criteria - like having fewer than 500 employees and no more than three approved generic drugs - can qualify for a 75% reduction on application and program fees. However, only 18 such certifications were processed in 2022, suggesting many eligible companies don’t apply, possibly due to confusion over eligibility rules or lack of awareness.

Why are generic drug review fees so much lower than brand-name fees?

Because generic drug applications are less complex. They don’t require new clinical trials - they rely on data from the original brand-name drug. The FDA reviews them for bioequivalence and manufacturing quality, not safety from scratch. The lower fee reflects the lower workload. In 2023, brand-name application fees were over $3.4 million, while generic fees were just under $125,000 - less than 4% of the cost.

Does paying user fees guarantee faster approval?

No. Paying fees ensures your application gets reviewed within a set timeframe - not that it gets approved. The FDA still requires strict standards for safety, effectiveness, and manufacturing quality. Many applications are rejected or require resubmission. Fees pay for review speed, not approval outcomes.

What happens if a company doesn’t pay the user fees?

The FDA will not review their application. If fees aren’t paid on time, the application is considered incomplete and won’t be accepted. For companies with approved drugs, failure to pay annual program or facility fees can lead to withdrawal of approval. The FDA tracks payments through its electronic system, and non-payment stops the process cold.

11 Comments

Priya PatelJanuary 11, 2026 AT 10:37

Okay but can we talk about how wild it is that my $4 insulin is here because some guy at the FDA didn’t have to wait 3 years for paperwork to clear? I just take my pill and forget about it - but this whole system is basically magic if you think about it.

Christian BaselJanuary 13, 2026 AT 00:51

Let’s be real - GDUFA is just regulatory capture dressed up as efficiency. The FDA’s ‘timelines’ are benchmarks for corporate convenience, not patient outcomes. And don’t get me started on the DMF fee arbitrage - it’s a compliance tax masquerading as a market mechanism.

Michael PattersonJanuary 13, 2026 AT 12:40

so like... i read this whole thing and i still dont get why the fees are so high for big pharma but low for generics? like if its just bioequivalence why not make it free? also i think the FDA is just lazy and this is their way of outsourcing work to companies who can afford it. also i saw a typo in the article where it said 'appplication' with 3 p's lol

Matthew MillerJanuary 14, 2026 AT 17:08

Oh wow, another feel-good story about how corporations are saving us from themselves. Let me guess - the FDA is now a glorified billing department? And the real winners are the same six companies that control 60% of the market? Pathetic. This isn’t innovation - it’s consolidation under the guise of accessibility. You think a small manufacturer in Ohio can survive this? Please. They’re just waiting to be bought out.

Madhav MalhotraJanuary 15, 2026 AT 00:00

As someone from India where generics are the backbone of healthcare, this is fascinating. We’ve been exporting generics for decades, but seeing how the U.S. system works behind the scenes? Mind blown. The fact that fees are tied to approval timelines instead of just being a tax? That’s actually smart. We need more of this kind of structure back home.

Sam DaviesJanuary 16, 2026 AT 03:24

Ah yes, the noble user fee - where the FDA, once a public watchdog, now runs a boutique consulting firm for Big Pharma. How quaint. You pay, you get your place in line. The rest of us? We just hope our prescriptions don’t expire before the backlog clears. Bravo. A+ for capitalism.

Roshan JoyJanuary 18, 2026 AT 01:24

Just wanted to say - if you’re a small biz owner reading this, check out the 75% fee waiver. I know it sounds boring, but it’s literally free money. I helped a friend file last year and saved them $20k. The FDA has a whole guide on it - no jargon, just steps. Seriously, don’t let bureaucracy scare you off.

Adewumi GbotemiJanuary 18, 2026 AT 06:29

So this is how America keeps medicine cheap? Cool. In Nigeria, we get generics from India and China, no fees, no forms, just shipped in. But I get it - your system is more organized. Still, if a small company can’t afford the fee, does that mean people go without? That’s the real question.

Jason ShrinerJanuary 18, 2026 AT 15:53

the FDA is just a middleman now. like... you pay to play. and the real winners? the ones who already own the market. genius. absolute genius. i’m crying with joy. 🤡

Sean FengJanuary 20, 2026 AT 11:08

The fee structure is a mess. No one understands it. Small companies get crushed. The FDA doesn’t help. That’s it.Alex SmithJanuary 22, 2026 AT 09:08

Look - I get why this system exists. But let’s not pretend it’s fair. The fact that 18 small businesses applied for the 75% discount out of hundreds that qualify? That’s not a policy failure - that’s a communication failure. Someone needs to go into rural clinics and manufacturing hubs and explain this in plain language. Not just post it on a PDF nobody reads. If we want real access, we need real outreach - not just more fees.